Navigating the complexities of international shipping can be daunting, especially when it comes to mastering the Incoterms rules. These internationally recognized trade terms are crucial for defining the responsibilities of buyers and sellers in cross-border transactions. Whether you’re new to e-commerce or looking to refine your logistics strategy, understanding the 11 Incoterms is essential for ensuring smooth and efficient operations.

In this comprehensive guide, we’ll break down the latest updates from Incoterms 2020, providing clear explanations and practical examples tailored for e-commerce businesses. You’ll learn how to use these trade terms to your advantage, minimise risks, and improve your supply chain efficiency. Ready to become an Incoterms expert and elevate your e-commerce game? Let’s dive in!

Table of contents

Do you want to have all our expert knowledge on Incoterms at your fingertips? Download our handy cheat sheet today!

What are Incoterms codes?– Incoterms explained

Incoterms (International Commercial Terms) were developed in 1936 by the International Chamber of Commerce. It is the solution for an international trade problem where parties from different countries can interpret transport agreements differently.

Incoterms are literally standardised international delivery terms, which serve as a contract between seller and buyer. They describe all tasks, risks, and costs associated with the transaction of goods worldwide and are thereby the most important trading conditions.

When are Incoterms used?

Incoterms are used to agree on the most important contractual terms and obligations for global trade. This includes the export, import, and transit of goods. The transport contract, transport insurance, the determination of the place of delivery and transfer of risk, information obligations and more are determined by the Incoterms.

In total there are 11 different Incoterms. The main difference between these International Commercial Terms is the point where the risk shifts from seller to the buyer. So from what time is the buyer responsible for:

- the costs of transport

- the risk of shipment

- the insurance

Incoterms answer the following questions:

- Which party is responsible for…

- the shipping costs?

- insurance costs?

- the import costs?

- customs clearance?

- transport and where does this go?

- liable for the goods and until when?

In short, Incoterms are the solution for an international trade problem whereby parties from different countries can interpret transport agreements differently. This was first recorded in 1936 and the Incoterms have been changed seven times since. Every 10 years they are updated or adapted to the new circumstances. The most recent rules are currently Incoterms 2020.

The function of Incoterms

Incoterms play a major role in the international shipment of goods. We summarised the various functions and benefits for you:

Main functions of the Incoterms:

- Standardisation: Ensures all parties are on the same page regarding terms and conditions.

- Cost allocation: which contract partner bears which costs?

- Division of obligations: which contract partner takes on which obligations on which route?

- Risk transfer: which contract partner covers which risk at which moment in time?

- Improved Communication: Facilitates better communication and understanding between international trade partners.

Other functions of the Incoterms:

- Goods documents: which contract partner buys the required goods documents?

- Customs: which contract partner is responsible for customs clearance?

- Transport documents: which contract partner buys which transport documents?

- Shipping insurance: which contract partner insures the goods for which part of the transport?

- Information: which contract partner informs the other at what time and about what?

- Goods inspection: which contract partner carries out the goods inspection?

- Packaging: which contract partner determines the type and packaging method?

How to use Incoterms

It is the seller’s responsibility to determine which incoterm is used. For vendors who are sending goods from the UK to outside the EU, the Incoterms need to be clearly stated on your commercial invoice. This is also where you state your HS codes.

Top tip: Always include Incoterms in your company’s terms and conditions. This helps your customers understand their responsibilities for the shipping process, including costs with customs or insurance.

Adding your Incoterms to your T&Cs will also help protect you in the case of a failed delivery. Remember, not all customers will understand what each Incoterm means. Make sure that you describe the Incoterm(s) in clear and plain language. Explain each condition so your customers can understand what it means for them and what they need to do.

Make sure to keep in mind that carriers might not support all Incoterms, and this is important to know when you decide your Incoterms. Check with the carrier you plan to ship internationally which Incoterms they support before deciding.

Importance of Incoterms in international trade

Incoterms are essential in international trade as they provide a standardised set of rules that help avoid misunderstandings between buyers and sellers from different countries. By clearly defining who is responsible for shipping, insurance, customs, and other logistics, Incoterms ensure that both parties understand their obligations and can prevent costly disputes. They streamline the entire process, making global trade smoother and more predictable, which is especially crucial in the fast-paced world of e-commerce.

By adopting Incoterms, businesses can navigate the complexities of international trade with greater confidence and efficiency, ultimately leading to more successful and profitable transactions.

Would you like to find out more about how you can make your international shipping cost-efficient? Have a look at our blog 12 tips to reduce your international shipping costs!

Incoterms and Brexit

Shipping to Europe after Brexit now means that customs declarations and other international trading processes are included if you want to sell your products to customers in any of the EU Member States. You will need to use Incoterms to clarify the responsibilities for tax and other duties.

Lots of new changes have been introduced with Brexit, so make sure you’re also clued up on EU VAT, EORI numbers, and the rules of origin as well!

Incoterms 2019 vs Incoterms 2020

Incoterms are updated every 10 years to keep pace with developments. The 2010 Incoterms remain valid, but in the end, more and more companies will transfer to the newer terms. It is therefore important to switch to the Incoterms of 2020, helping to prevent confusion.

Here is a summary of the main changes in Incoterms 2020:

- DAT is now DPU: Delivered at Place Unloaded (known as Delivered at Terminal) includes goods being delivered at any point where it is possible to load goods. Delivered at Terminal only included a terminal or dock. Now, factories and warehouses are also covered with DPU.

- FCA now includes the on-board Bill of Lading (BL): A required Bill of Lading can now be specified in the sales agreement. The Bill of Lading indicates that goods have been loaded on board. Therefore, the buyer tells the carrier to hand over this “note of board” to the seller.

- CIF and CIP have different levels of insurance coverage: The seller must take out comprehensive transport insurance with CIP. But with CIF, only insurance with minimal coverage is required.

- FCA, DAP, DPU, and DPP now have their own means of transport: It is possible to arrange the transport of goods with their own means of transport.

Different Incoterms explained: A detailed breakdown

Here’s a detailed breakdown of each Incoterm, along with practical examples of how they are used in international shipping.

1: EXW – Ex Works

Access to goods must be given to the buyer from the seller at a determined location. After that, all costs and risks are then the responsibility of the buyer for the entire shipping process.

Example: A manufacturer in Germany sells machinery to a buyer in Brazil. The buyer arranges pickup from the manufacturer’s warehouse and handles all subsequent transportation and customs clearance.

2: FCA – Free Carrier

The goods must be made available at the seller’s own risk and expense at their own premise or a predetermined place. The seller then bears responsibility for the clearance of the goods for export. However, it can be agreed that the buyer must instruct the carrier to transfer a “Bill of Lading (BL)” with a note on board to the seller.

Example: A clothing exporter in Italy delivers garments to a freight forwarder at a local port. The buyer in Japan arranges the shipping from the port to their warehouse.

3: CPT – Carriage Paid To

For the seller, CPT has the same responsibilities as FCA, but they must also pay the delivery costs.

Example: A French winery sells a shipment to a retailer in Canada, paying for the transportation to the port of Montreal. The buyer then handles the goods from the port onwards.

4: CIP – Carriage Insurance Paid To

The seller has the same obligations as CPT, but the seller is also obliged to pay the insurance with a high coverage ratio. Parties can agree separately to apply limited coverage.

Example: A tech company in the USA ships electronics to a distributor in Australia, covering both the transport costs and insurance until the goods reach Sydney.

5: DAP – Delivered At Place

The costs and risks are the seller’s responsibility during the transport of the goods to the predetermined address. Once the goods arrive at this address and they are ready for unloading, the risk then passes to the buyer.

Example: A furniture manufacturer in Sweden delivers a batch of tables to a buyer’s warehouse in London. The buyer takes over responsibility upon arrival.

6: DPU – Delivered at Place Unloaded

The costs and risks of delivering goods to an agreed destination where the goods can be unloaded for further transport are the responsibility of the seller. The seller also arranges customs and unloads the goods at the agreed place. Then the buyer arranges the customs clearance and any associated rights.

Example: A company in China ships machinery to a factory in Mexico, handling all transport and unloading at the destination. The buyer takes over after unloading.

7: DDP – Delivered Duty Paid

The seller must pay the costs and is responsible for the risks of transport. They also carry out the export and import responsibilities and pay any import duties. The risk then passes to the buyer as soon as the goods have arrived at the address and are ready for unloading.

Example: A Canadian supplier delivers medical equipment to a hospital in the UK, covering all transport costs, duties, and import formalities.

8: FAS – Free Alongside Ship

The seller is responsible for all costs and risks up until the point the goods are delivered next to the ship. The risk then transfers to the buyer from that point, and the buyer must also arrange the export clearance and import clearance.

Example: An agricultural exporter in Argentina delivers soybeans alongside a vessel in Buenos Aires. The buyer arranges for loading and subsequent shipping to their destination.

9: FOB – Free On Board

The seller bears all costs and risks until the goods are on board the ship and also arranges the export clearance. As soon as the goods have been delivered to the ship, the buyer bears all responsibilities.

Example: A supplier in Thailand ships rice to a buyer in Egypt, taking responsibility until the rice is loaded onto a ship at the port of Bangkok.

10: CFR – Cost And Freight

CFR is the same for the seller and buyer as FOB. However, the seller needs to also pay for the transport of the goods to the port.

Example: A machinery manufacturer in Japan ships equipment to a customer in India, covering shipping costs to the port of Mumbai, while the buyer takes on the risk once the goods are onboard.

11: CIF – Cost, Insurance, and Freight

The seller has the same obligations as with CFR but also pays the (minimum) insurance costs. The buyer must pay for more comprehensive insurance.

Example: A car parts supplier in South Korea sells parts to a dealer in South Africa, paying for shipping and insurance to the port of Durban. The buyer is responsible for additional insurance if needed.

Incoterms Groups

To clarify the processes and responsibilities for both vendor and customer, Incoterms can be divided into four groups:

- Group E: EXW is the only “collection” Incoterm. This means the buyer is responsible for almost almost all costs and risks during the entire shipping process.

- Group F: In this group, the seller doesn’t cover the costs and risks of the transport in the Incoterms FCA, FAS, and FOB (all the terms beginning with F). The costs and the risk of the main transport are transferred to the buyer as soon as the goods are passed to the carrier.

- Group C: CPT, CIP, CFR, and CIF are the Incoterms where the seller is responsible for all the main transport costs. Once the goods are passed to the carrier, the risk of transportation is the only thing transferred to the buyer. The seller is still responsible for the costs and any insurance.

- Group D: The seller is responsible for all costs and risks until the arrival of the goods to the predetermined destination with DAP, DPU, and DPP.

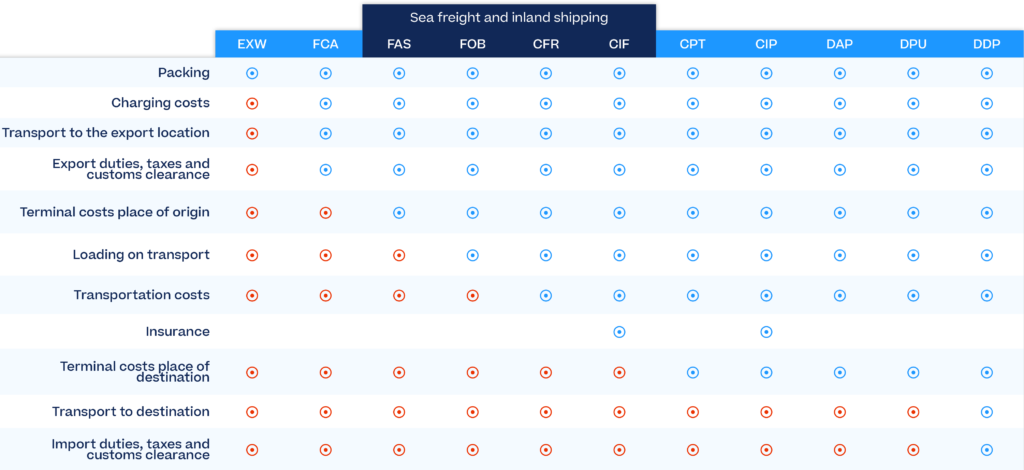

Overview of the obligations of the buyer and seller

In the overview below, you can see at a glance which party has the responsibilities and obligations, for example, for loading orders on transport or paying taxes. The seller’s obligations are highlighted in blue, and the buyer’s obligations are highlighted in red.

Which Incoterms should I use?

If you are an online merchant that sells internationally, Incoterms (Delivered At Place) is the most commonly used Incoterm. If you are a B2C vendor sending a package overseas but are unsure on the right Incoterm to use, DAP is a good choice.

DAP states that it is your responsibility to pay shipping costs, prepare export documentation and deal with any insurance required. The responsibility for import and customs costs lies with the recipient.

Ship internationally with Sendcloud

Are you planning to ship internationally? Or do you want to optimise your international shipping strategy? With Sendcloud’s international shipping, you can connect your webshop with all major carriers, including DHL Express, DPD, and UPS. Easily automate every part of your shipping process: from printing shipping labels to sending personalised Track & Trace notifications and handling returns.

What sets Sendcloud apart is our ability to generate custom forms automatically with all the necessary information included, ensuring a smooth and paperless process. Even if a carrier doesn’t support paperless trade, we’ve got you covered – we generate the required documents for you.

In addition, immediately benefit from the favourable international shipping conditions that Sendcloud has negotiated with the carriers. This includes Paperless Trade, importing customs information automatically from Shopify and API integrations, as well as benefiting from being connected to a network of carriers across Europe. Curious what this will bring to your webshop?

Discover how Sendcloud works now – sign up for free!