Navigating international shipping regulations can be daunting, especially when it comes to customs declarations—but it doesn’t have to be! In this comprehensive guide, we’ll demystify CN22 and CN23 forms, which are essential for UK businesses engaged in international shipping as they give important information about the contents of the package being shipped abroad.

Properly completing these forms ensures your shipments clear customs quickly and helps avoid costly delays. So, let’s dive in and get started! We’ll cover everything you need to know — from understanding when to use them to mastering the filling process.

This article covers:

- Customs declarations CN22 and CN23: definition

– Customs declarations after Brexit - The difference between the CN22 and CN23 custom declarations

- Customs forms: when do you need to use them?

- CN22 customs form

– How to fill out the CN22 customs declaration? - CN23 customs form

– How to fill out the CN23 customs declaration? - Generate your own CN22/CN23 customs form

Customs declarations CN22 and CN23: definition

CN22 and CN23 custom declarations are required customs documents for international shipping. They help customs officials understand what is in the package so they can process them swiftly and compliantly.

Any shipment that is sent through Royal Mail that contains items with a commercial value requires a CN22 or CN23. This is because they will be subject to fees and taxes. You do not need a CN22 or CN23 when you ship using an international courier such as UPS or DPD. When you ship using an international courier you need to supply a commercial invoice.

Important note: when internationally shipping products that have a value up to £270 you must attach a signed and dated CN22. If the value is greater than £270 you must use a Customs Declaration CN23.

Parcels being shipped internationally are often read by a scanner. If your CN22 or CN23 customs declaration does not accurately describe the contents of your parcel, then you may be fined up to 100% of the actual value of the merchandise.

Customs declarations after Brexit

Since Brexit, UK e-commerce retailers are required to complete a CN22 or CN23 customs declaration form when shipping goods to EU countries. Additionally, your EORI number must be included with the commercial invoice to ensure smooth customs clearance. Not including the EORI can lead to delays, extra fees, or even having your shipments sent back.

Don’t know what an EORI number is or how the Rules of Origin work? Then be sure to check out our guides for more information.

What is the difference between the CN22 and CN23 customs declarations?

Determining when to use a CN22 or a CN23 actually depends on the weight and value of the package. If the package you wish to send weighs up to 2KG and has a value of up to £270, then you will need to complete and attach a CN22. The CN22 is a simpler form than the CN23. It is generally a sticker that you can attach to the side of the parcel (alongside the shipping label).

You will therefore need a CN23 declaration form when the package weighs more than 2KG and/or has a value higher than £270. This form contains a lot more information, and generally it is attached to the outside of a package in a transparent wallet (along with a CP71 dispatch note). Again, it’s best to attach this wallet to the same side as your shipping label to help with a quick and easy passing through customs.

Important note – it is vital that the CP71 form is included as a supplement to the CN23. The CP71 dispatch form is used as an address card you should place it inside the transparent envelope containing your customs documents so that it is clearly visible. Unlike the CN23, the CP71 does not show the value of the individual items. The CP71 acts as an address card.

You might need to also include a commercial invoice as well as a CN22/CN23, but this depends on the carrier and destination. Generally, we recommend you include both forms as this means your package will be fully covered and you won’t be hit by any delays. It’s also wise to provide three copies of the commercial invoice: one for the country you are shipping from, one for the destination country and one for the recipient.

To summarise, when to use a CN22/CN23 form:

| CN22 | CN23 |

| For international shipments weighing up to 2 kilograms and with a value of up to £270. | For international shipments weighing more than 2 kilograms and/or with a value over £270. |

Customs forms: when do you need to use them?

Knowing when to use a customs form is the key to ensuring a smooth delivery and compliance with international shipping laws. Here’s a breakdown of when you’re required to use a customs form:

Customs declarations post-Brexit

Since the UK left the EU, all mail sent to EU member states through Royal Mail or other national postal services will require a CN22 or CN23 customs declaration, depending on the package’s value and weight. For shipments via private couriers like DHL Express or DPD, you’ll often need a Commercial Invoice. However, it’s recommended to also include a CN22 or CN23 form, as these forms are recognised worldwide and can speed up customs clearance.

If shipping to a non-EU country where the UK does not have a Free Trade Agreement (FTA), customs forms will always be required. For a comprehensive overview of all EU countries, be sure to check out the website of your national tax authority.

Regions with customs exceptions

When shipping to certain EU regions that are not part of the EU customs union, such as Ceuta, Melilla, or the Canary Islands, you’ll still need to include a CN22 or CN23, regardless of whether they are part of the EU. Always check for any region-specific rules to ensure compliance.

Merchandise and documents

In general, merchandise shipments always require customs declarations, while documents may not. However, this can vary depending on the destination country. For example, in some countries like the Bahamas, items such as photographs are classified as documents, while in Argentina, they are treated as merchandise and subject to customs control. Always check local customs rules if you’re unsure.

National postal service vs. private carriers

When using Royal Mail or any other national postal service for international shipping, customs forms (CN22/CN23) are mandatory. Even with private couriers like DHL, FedEx, or UPS, it’s a good idea to include CN22 or CN23 forms alongside your Commercial Invoice. These forms provide a standardised format that customs authorities are familiar with, which helps facilitate smoother processing.

Summary of customs declaration requirements

| Shipping situation | Required? | Examples |

| Shipping to a country outside the UK and EU |

✅ |

Shipping from the UK to the USA, China, Australia |

|

Shipping within the UK |

❌ |

Domestic shipping from London to Edinburgh |

| Shipping to the EU (post-Brexit) |

✅ |

Shipping from the UK to France, Germany, Spain |

| Shipping to UK territories outside the customs union |

✅ |

Shipping to Gibraltar, Channel Islands |

| Shipping to EU regions with different VAT requirements |

✅ |

Shipping from the UK to Canary Islands, Ceuta, Melilla |

| Shipping merchandise |

✅ |

Electronics, clothing, books |

| Shipping documents |

May vary |

Photographs (Different rules by country: Bahamas may treat as document, Argentina as merchandise) |

| Using national postal service for international shipping |

✅ |

Royal Mail (UK) |

| Using private carriers for international shipping |

Recommended |

DHL, UPS, FedEx, DPD |

CN22 customs form

You must fill out a CN22 customs declaration if you are shipping a package that weighs less than two kilograms and has a value of less than £270. It is extremely important that you fill out the customs declaration correctly and as completely as possible.

The CN22 must be used if your goods are being transported outside of the UK, up to the value of £270*. The CN23 should be used if the value of your goods being transported outside of the EU have a value of over £270.

*Important note: When the UK leaves the European Union, any mail being sent to the EU from the UK will require a CN22/23 attachment when being sent with postal couriers.

Failure to do this might result in delays or confiscation at customs – or even a fine.

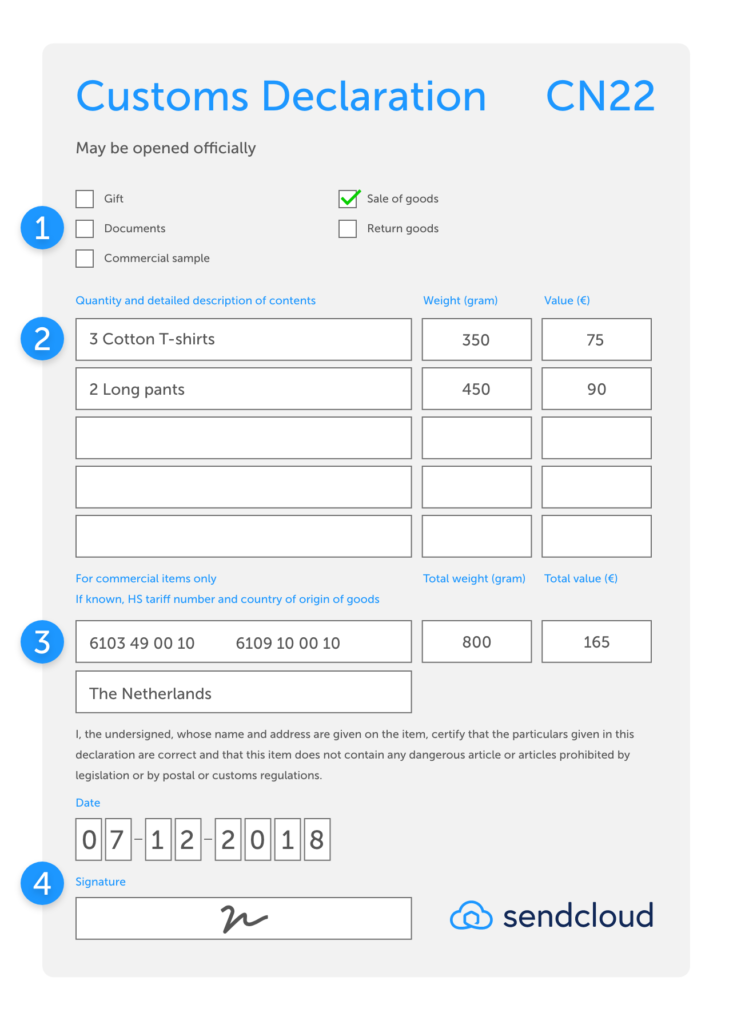

How to fill out a CN22 customs declaration

Step 1: Place a cross or tick-mark to indicate the contents of the parcel. For online retailers who sell products internationally, the choice will usually be ‘Sale of goods’. You may select ‘Commercial sample’ if you are only shipping samples or testers of your product. You can only choose one option per parcel.

Step 2: Specify what’s inside the parcel. If you are shipping retail merchandise, commercial samples or return items, you must provide a detailed description of the contents. Always write the description in English or in the language of the destination country. The more clearly you describe the contents, the better your chances that the parcel will pass smoothly through customs. Always specify the product/product group:

- What type of product is it?

- What is the quantity?

- How much does it weigh?

- What is the retail value in euros (excluding VAT)?

Step 3: Provide the international commodity code and the product’s country of origin. State the country in which the merchandise was produced or assembled and include the Harmonised System (HS) code for your product(s).

HS code and CN22

-

- The HS code is a multi-digit code used by customs authorities around the world to categorise products.

- HS codes contain ten digits, of which the first six are internationally standardised.

- Always include at least a six-digit code. If possible, also define the subcategory of your product.

- Depending on the country, different subcategories may be subject to different tax rates.

Remember: The way EU VAT is processed has now changed due to Brexit. Make sure you are familiar with the new process.

Step 4: Write the date of the shipment and sign the form. By signing the form, you declare that the document has been filled out correctly and that the parcel does not contain any banned or dangerous items. If the form is not signed, the shipment may be delayed or returned.

The items listed below are often not allowed to be shipped internationally:

- Aerosol sprays

- Alcoholic beverages

- Cigarettes

- Products with a limited shelf life

- Petrol or oil

- Fingernail polish

- Perfume

- Poison

- Lighters

- Fire extinguishers

- Gas masks

- Lottery tickets

- Rough diamonds

- Damaged batteries

Check the website of your national postal service for a general overview of goods and materials that are banned from international shipping. Your postal service should also be able to provide you with a list of items that are banned for shipment to each specific country.

CN23 customs form

Always use the CN23 for packages that weigh more than 2 kilograms and/or are valued at more than £270. The CN23 form is similar to the CN22, but you will need to supply more information.

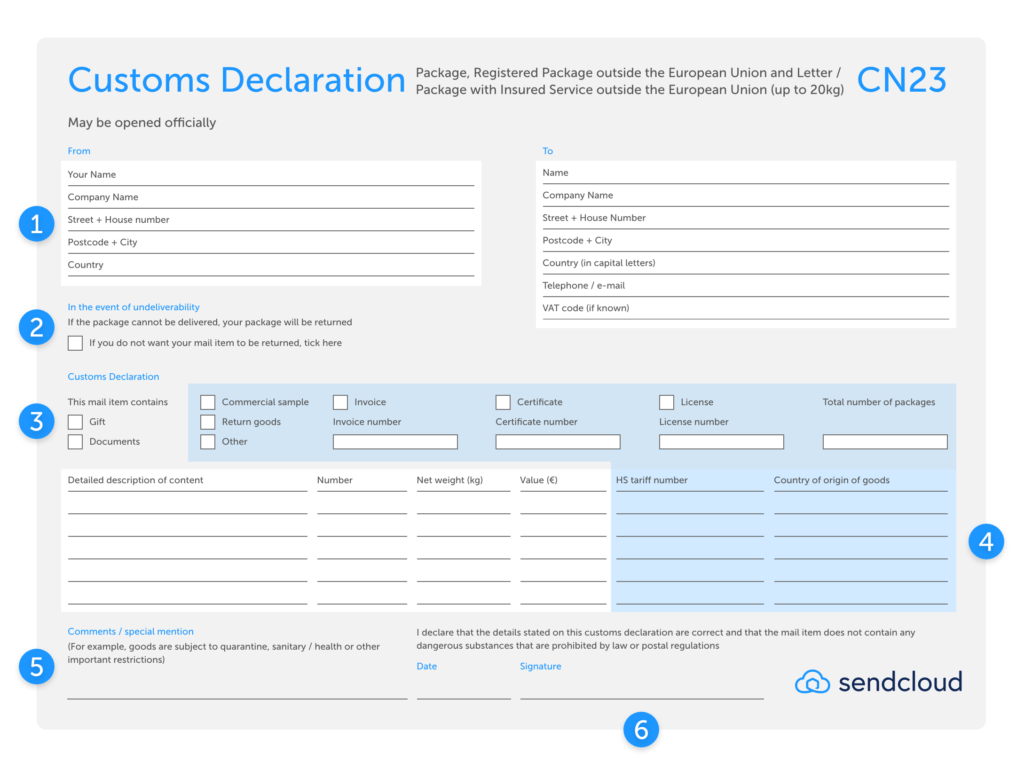

How do you fill out a CN23 customs declaration

Step 1: Fill in the address information of the sender and receiver. To increase your chances of successful delivery, be sure to provide all the address details you know. Also include the customer’s telephone number, because, in some cases, it may be necessary to call them.

Step 2: If a customs document or label isn’t completed correctly, you risk your package not being delivered, or the receiver refusing to take the package. Clearly state whether you want the package returned to you to avoid a loss. However, do note that there will likely be a return shipping cost. If the return costs aren’t worth it, then make sure to clearly state you don’t wish for the package to be returned.

Step 3: Specify what’s inside the parcel. Choose between commercial sample, return shipping or other. Also fill out the light blue shaded sections. Always describe the contents of the parcel as precisely as possible.

HS code and CN23

Step 4: Supplying the HS, or commodity code.

The HS or commodity code is a multi-digit code used by customs authorities around the world to categorise products. It is important to supply the correct HS code. Here are a few important steps to help you get it right.

A. Firstly, state the country in which the merchandise was produced or assembled and include the Harmonised System (HS) code for your product(s). The same rules apply here as for the CN22 form. You can use our handy tool to find the right HS Code for your products.

B. Make sure your code contains the correct six digits. These are the figures that are internationally standardised.

C. If possible, you should also define the subcategory of your product. Depending on the country, different subcategories may be subject to different tax rates.

If you can’t find the subcategory, don’t worry. The six-digit HS code is generally all you need to include. For more information, refer to the website of your national customs authority or visit www.tariffnumber.com or foreign-trade.com for a list of the HS codes.

Step 5: Comments — In some cases, your products may need to be quarantined, or ensue health/sanitation restrictions or other import regulations depending on what you sell. This mostly includes food, medicine or living organisms.To make sure your products arrive on time and in good condition, make sure you provide this information on all relevant customs declarations.

Step 6: It sounds obvious, but don’t forget to write the date and sign the form. Fail to do this and the form is not legally valid. And this means your package is likely to be delayed or even stopped being delivered altogether. By signing and dating the form you are stating that the documents have been filled out correctly and that the parcel does not contain any banned or dangerous items.

Top tip: Keep copies of your documentations. If there’s a problem with customs, you can easily refer back to your records to check. This helps you or your customers avoid being overcharged by customs authorities.

Free tool: Create your own CN22/CN23 form

We love to make things easier for you. So we have developed a tool to help you easily generate the correct customs forms, which are ready-to-print and can be included with your international shipments. The tool will automatically complete all the required fields and determine whether you need to complete a CN22, CN23, commercial invoice or check the incoterms.

Check it out now!

Make your international shipping better with Sendcloud

Streamline your international shipping process and ensure compliance with customs regulations with Sendcloud. Whether you’re shipping to countries outside the EU or within, our platform simplifies the customs declaration process for CN22 and CN23 forms.

By integrating Sendcloud into your shipping workflow, you can:

- Automatically generate CN22 and CN23 customs declarations based on your shipment details

- Ensure accuracy and completeness in your customs documentation, reducing the risk of delays or fines

- Seamlessly manage shipments to various destinations, whether you’re using national postal services or private carriers

- Access a user-friendly interface that guides you through the customs declaration process, saving you time and effort

Learn all about international shipping with Sendcloud or sign up today to experience hassle-free customs declaration and efficient shipping worldwide.