Customs declarations – CN22 and CN23 customs declarations are essential for international shipping. The documents give important information about the contents of the package being shipped abroad. It is vital that all UK e-commerce retailers have a thorough understanding of how to fill out CN22 and CN23 forms properly. The forms help ensure your shipments clear customs quickly. To avoid delays with your international shipments, make sure to always fill out these documents as fully as possible.

In this blog post, we’ll tell you everything you need to know about the CN22 and CN23 customs declarations, including exactly how to use them.

Want to quickly create your own CN22 or CN23 form? We’ve also got you covered there with our free tool.

This article covers:

- Customs declarations CN22 and CN23: definition

- Customs declarations after Brexit

- The difference between the CN22 and CN23 custom declarations

- Customs forms: when do you need to use it?

- CN22 customs form

- CN23 customs form

- Create your own CN22/CN23 customs form

Before we start, make sure to download our International Shipping Checklist. In this document, you’ll find a complete walkthrough of everything you’ll need for smooth international shipping.

Customs declarations CN22 and CN23: definition

CN22 and CN23 custom declarations are required customs documents for international shipping. They help customs officials understand what is in the package so they can process them swiftly and compliantly.

Any shipment that is sent through Royal Mail that contains items with a commercial value requires a CN22 or CN23. This is because they will be subject to fees and taxes. You do not need a CN22 or CN23 when you ship using an international courier such as UPS or DPD. When you ship using an international courier you need to supply a commercial invoice.

Important note: when internationally shipping products that have a value up to £270 you must attach a signed and dated CN22. If the value is greater than £270 you must use a Customs Declaration CN23.

Parcels being shipped internationally are often read by a scanner. If your CN22 or CN23 customs declaration does not accurately describe the contents of your parcel, then you may be fined up to 100% of the actual value of the merchandise.

Customs declarations after Brexit

With the changes from Brexit, e-commerce retailers will need to complete either a CN22 or CN23 customs declaration form when shipping to Europe.

With your shipments to EU member states, you will also need to include your EORI number on your CN22 or CN23 forms. Don’t know what an EORI number is or how the Rules of Origin work? Then make sure to checkout our guides for more information.

What is the difference between the CN22 and CN23 customs declarations?

Determining when to use a CN22 or a CN23 actually depends on the weight and value of the package. If the package you wish to send weighs up to 2KG and has a value of up to £270, then you will need to complete and attach a CN22. The CN22 is a simpler form than the CN23. It is generally a sticker that you can attach to the side of the parcel (alongside the shipping label).

You will therefore need a CN23 declaration form when the package weighs more than 2KG and/or has a value higher than £270. This form contains a lot more information, and generally it is attached to the outside of a package in a transparent wallet (along with a CP71 dispatch note). Again, it’s best to attach this wallet to the same side as your shipping label to help with a quick and easy passing through customs.

Important note – it is vital that the CP71 form is included as a supplement to the CN23. The CP71 dispatch form is used as an address card you should place it inside the transparent envelope containing your customs documents so that it is clearly visible. Unlike the CN23, the CP71 does not show the value of the individual items. The CP71 acts as an address card.

You might need to also include a commercial invoice as well as a CN22/CN23, but this depends on the carrier and destination. Generally, we recommend you include both forms as this means your package will be fully covered and you won’t be hit by any delays. It’s also wise to provide three copies of the commercial invoice: one for the country you are shipping from, one for the destination country and one for the recipient.

Customs forms: when do you need to use it?

After the UK leaves the EU any mail being sent to EU states via the Royal Mail (or other postal services) will require a CN22/23. International couriers such as DHL Express or DPD do not require a CN22/23. In this instance you need to supply a Commercial Invoice.

Also, take note of any regions where exceptions may apply. There are regions that are within the EU but are not part of the EU customs zone. Shipments to these regions are subject to customs control, so you must always include a CN22 or CN23 customs declaration with them too.

In general, merchandise is subject to customs control, but documents are not. However, the rules may vary from one country to the next. In the Bahamas, for example, a photograph is considered a document (not subject to customs control), while in Argentina, photographs are considered merchandise and must pass through customs.

CN22 customs form

You must fill out a CN22 customs declaration if you are shipping a package that weighs less than two kilograms and has a value of less than £270. It is extremely important that you fill out the customs declaration correctly and as completely as possible.

The CN22 must be used if your goods are being transported outside of the UK, up to the value of £270*. The CN23 should be used if the value of your goods being transported outside of the EU have a value of over £270.

*Important note: When the UK leaves the European Union, any mail being sent to the EU from the UK will require a CN22/23 attachment when being sent with postal couriers.

Failure to do this might result in delays or confiscation at customs – or even a fine.

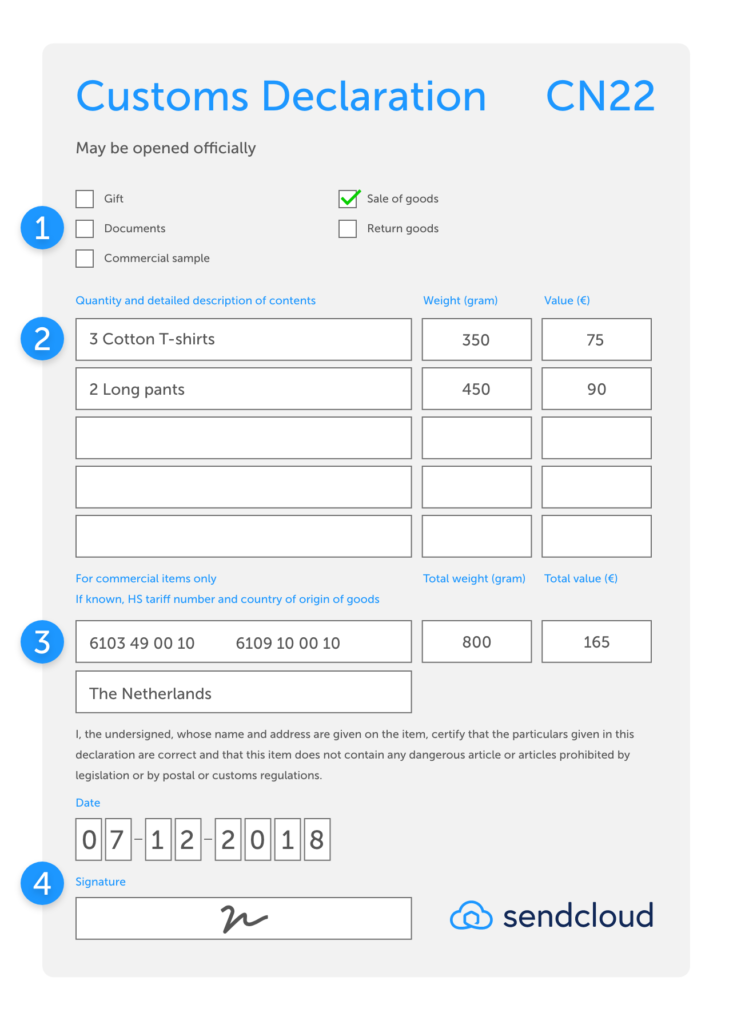

How to fill out a CN22 customs declaration?

1: Place a cross or tick-mark to indicate the contents of the parcel. For online retailers who sell products internationally, the choice will usually be ‘Sale of goods’. You may select ‘Commercial sample’ if you are only shipping samples or testers of your product. You can only choose one option per parcel.

2: Specify what’s inside the parcel. If you are shipping retail merchandise, commercial samples or return items, you must provide a detailed description of the contents. Always write the description in English or in the language of the destination country. The more clearly you describe the contents, the better your chances that the parcel will pass smoothly through customs. Always specify the product/product group:

- What type of product is it?

- What is the quantity?

- How much does it weigh?

- What is the retail value in euros (excluding VAT)?

3: Provide the international commodity code and the product’s country of origin. State the country in which the merchandise was produced or assembled and include the Harmonised System (HS) code for your product(s).

HS code and CN22

-

- The HS code is a multi-digit code used by customs authorities around the world to categorise products.

- HS codes contain ten digits, of which the first six are internationally standardised.

- Always include at least a six-digit code. If possible, also define the subcategory of your product.

- Depending on the country, different subcategories may be subject to different tax rates.

Remember: The way EU VAT is processed has now changed due to Brexit. Make sure you are familiar with the new process.

4: Write the date of the shipment and sign the form. By signing the form, you declare that the document has been filled out correctly and that the parcel does not contain any banned or dangerous items. If the form is not signed, the shipment may be delayed or returned.

The items listed below are often not allowed to be shipped internationally:

- Aerosol sprays.

- Alcoholic beverages.

- Cigarettes.

- Products with a limited shelf life.

- Petrol or oil.

- Fingernail polish.

- Perfume.

- Poison.

- Lighters.

- Fire extinguishers.

- Gas masks.

- Lottery tickets.

- Rough diamonds.

- Damaged batteries.

Check the website of your national postal service for a general overview of goods and materials that are banned from international shipping. Your postal service should also be able to provide you with a list of items that are banned for shipment to each specific country.

CN23 customs form

Always use the CN23 for packages that weigh more than 2 kilograms and/or are valued at more than £270. The CN23 form is similar to the CN22, but you will need to supply more information.

How do you fill out a CN23 customs declaration

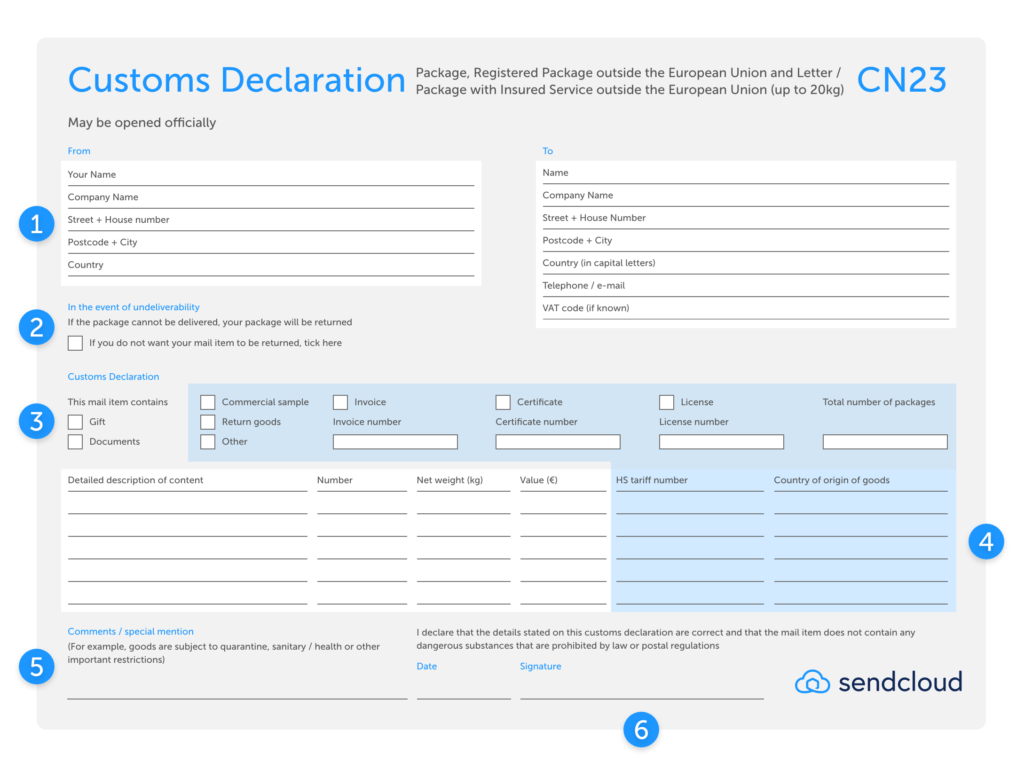

1: Fill in the address information of the sender and receiver. To increase your chances of successful delivery, be sure to provide all the address details you know. Also include the customer’s telephone number, because, in some cases, it may be necessary to call them.

2: If a customs document or label isn’t completed correctly, you risk your package not being delivered, or the receiver refusing to take the package. Clearly state whether you want the package returned to you to avoid a loss. However, do note that there will likely be a return shipping cost. If the return costs aren’t worth it, then make sure to clearly state you don’t wish for the package to be returned.

3: Specify what’s inside the parcel. Choose between commercial sample, return shipping or other. Also fill out the light blue shaded sections. Always describe the contents of the parcel as precisely as possible.

HS code and CN23

4: Supplying the HS, or commodity code.

The HS or commodity code is a multi-digit code used by customs authorities around the world to categorise products. It is important to supply the correct HS code. Here are a few important steps to help you get it right.

- Firstly, state the country in which the merchandise was produced or assembled and include the Harmonised System (HS) code for your product(s). The same rules apply here as for the CN22 form. You can use our handy tool to find the right HS Code for your products.

- Make sure your code contains the correct six digits. These are the figures that are internationally standardised.

- If possible, you should also define the subcategory of your product. Depending on the country, different subcategories may be subject to different tax rates.

If you can’t find the subcategory, don’t worry. The six-digit HS code is generally all you need to include. For more information, refer to the website of your national customs authority or visit www.tariffnumber.com or foreign-trade.com for a list of the HS codes.

5: Comments: In some cases, your products may need to be quarantined, or ensue health/sanitation restrictions or other import regulations depending on what you sell. This mostly includes food, medicine or living organisms.To make sure your products arrive on time and in good condition, make sure you provide this information on all relevant customs declarations.

6: It sounds obvious, but don’t forget to write the date and sign the form. Fail to do this and the form is not legally valid. And this means your package is likely to be delayed or even stopped being delivered altogether. By signing and dating the form you are stating that the documents have been filled out correctly and that the parcel does not contain any banned or dangerous items.

Top tip: Keep copies of your documentations. If there’s a problem with customs, you can easily refer back to your records to check. This helps you or your customers avoid being overcharged by customs authorities.

If you still have questions about the CN22 and CN23 customs declarations, then let us know in the comments below!

Create your own CN22/CN23 form

We love to make things easier for you. So we have developed a tool to help you easily generate the correct customs forms, which are ready-to-print and can be included with your international shipments. The tool will automatically complete all the required fields and determine whether you need to complete a CN22, CN23, commercial invoice or check the incoterms.

Check it out now!

If you’re looking for a tool to ship abroad and take care of your customs declarations try Sendcloud. for free!

Need help shipping to a particular country?

Check out the following guides for more specific advice on shipping to a particular nation:

If you’re a growing business looking to start shipping across Europe, download our International shipping made easy eBook below!

Firstly, thank you for providing so much helpful information. There is, however, one thing which I cannot determine: I know that if the retail value of an item being posted to an EU country is less than 22 Euros, it does not attract any duty: is it nonetheless mandatory to attach a commercial invoice to such an item?

Hi Linda,

Thanks for your kind compliments – we’re really glad to hear you have found value from the information we’ve been able to provide. And this is an interesting question. As you include the value of the goods on the CN22 form, I would say it is not necessary. BUT, we do always encourage that if you have some doubts, it is better to include the commercial invoice than leave it out and risk your packages facing delays with customs. It’s better to be safe than sorry.

What’s more, it also depends on whether you are shipping with a postal company, or an international carrier. International carriers do not require a CN22/CN23, so then you will need to detail the package’s value with a commercial invoice to prove it is under 22 euros. We have a full guide on commercial invoices, as well as a handy tool to quickly create an invoice for your own products.

Hi

this is very helpful, however, I am confused. do you know why the cutoff for mail couriers is £270 while for VAT HMRC states £135?

Thanks

Hi,

Thanks for your question! It’s an interesting one. To help explain, the £270 cut-off threshold is related to the couriers and the required customs forms for your shipment. If the item you are shipping is under £270, you will use a CN22 and if it is over £270, you will use a CN23. (But sometimes you will need a CN23 even if the value is under £270 as, if the package also weighs over 2KG, you will need a CN23). In regards to the £135 threshold from HMRC, this is due to the introduction of a new method for handling VAT. Imported goods (i.e. including multiple goods in single package) passing through UK customs border that are below £135 are now subject to a new VAT regime. This replaces the existing import VAT collection at clearance by customs, or customer import payments to the delivery agent. However, goods that are above £135, or shipments of multiple goods with a combined value above £135, use the old import VAT procedures. This means the seller may pay the import VAT (and duties) on clearance, and reclaim if they have a UK VAT number. Alternatively, the seller may opt to have their customer may pay at customs or to the delivery agent. I hope this helps clear up the difference between these two things?

Hi and thank you for the information.

Could I ask what are the rules for receiving a parcel from the EU (rather than sending it), please? I cannot find any form for this.

Thank you

Hi Ella,

I will try my best to give you the correct information. 🙂 In regards to receiving a package from the EU, this all depends on the type of package. The majority of the time, you will not need to create any forms as a receiver of a package (unless you’re arranging the shipment from the EU yourself). If you are receiving a gift

from a personal correspondent, then you will need to look into the Gift Aid allowance. In the UK, you are allowed to receive a gift up to the value of £39. After that, you will need to pay tax on it. The person sending the package from the EU will need to deal with the customs forms to ship the package. Once the package is delivered to the UK, the courier who handles the package will process the hold onto the package and issue you with a collection notice, including any fees you will need to pay to receive the package. This is the same if you purchase a product from a retailer or business based in the EU. The retailer will most likely organise all customs forms for you, and the item will be shipped into the UK. Once it arrives, the courier again will send you a notification detailing any VAT or duties you will need to pay (this depends on many things, like the item’s value, what it is, where the product comes from etc). I advise looking into the retailer’s terms of sale as to how they sell and ship products to the UK and which costs they cover and what you will be responsible for paying yourself.

I hope this has helped! If you want more info on how to arrange a shipment from EU to the UK, then you can head on over to our blog here where we detail the steps you’ll need.

I ordered baby goods from the Netherlands which came to 137 uk pounds, had I known about the 135 threshold I’d have dropped a baby bib)

The fee is 63 pounds

I haven’t paid as I’ve asked for a breakdown of how they came to this figure.

My question is,

While in transit the goods shave gone down in price, I’ve had a refund for the difference and now the goods value I’ve paid is below £135 and it was free uk delivery.

Where do I stand?

Ice parted with £101 uk pounds because that’s the value of the goods before they arrived.

However the fee still stands?

And it’s baby items, and the fee is nearly as much as the goods?

I am beyond disappointed, please help me!

Hi Nealey,

We generally help e-commerce retailers ship out their products so importing the goods through customs and into the UK isn’t my best area of expertise, but I will try to provide some things you might want to consider or look into to see why there is this charge and maybe if it can be reduced. But please be aware I may not have all the information. I definitely recommend getting in touch with the seller you purchased from and discussing it directly with them.

Firstly, this charge of 63 euros could include an admin fee from the carrier for the handling of the customs process. No matter if the value of the goods has changed, this admin fee will of course be a set rate, so will not change. I would check to see if this is part of the charge.

Secondly, regarding the fact that the value of the order has changed while the products were in transit, yet the charge has not subsequently been reduced, I would recommend you check with your seller if they have contacted customs and amended the commercial value with the customs offices. If they have not informed customs of this change, then customs will still believe the commercial value of the order to be the initial amount you paid, and therefore will be basing the import VAT and duties off of the higher amount.

I hope these two suggestions help you get to the bottom of this. Wishing you luck!

Hi, thank you for this helpful article.

I’m experiencing difficulties with using DHL in Germany to send documents (birth certificates) to the UK using their parcel service. Their online booking form includes a mandatory CN23 form which must be completed and in the drop-down menu one can select document, but it still asks for weight and value and will not accept zero. I haven’t managed to get anywhere with why this is either with UK or DE branches. I’ve had to book and complete it as the documents need to get there safely. For the value I put the total value if I had to order them again, so around 100 euros. They are going to the legalisation office which is a government body. Do you think Customs will see that they are documents and accept that they are exempt from duty irrespective of the value I had to put in (I didn’t want to put a nominal amount in case I need to claim insurance if they should lose the envelope!). I also thought I’d best put all the details even though documents are exempt so that they are not delayed if the package arrives without a CN22/23 form completed. DHL appear to be taking a sledge hammer approach and not even offering CN22!

Thanks in advance for any insight you can offer.

William

Hi Will,

Just to give you some more context, we at Sendcloud help e-commerce stores ship their products to their customers, so shipping legal documents isn’t really our area of specific expertise. I will try to give you the best advice with the information you’ve provided, but I highly recommend that you contact the customer service team of DHL for better insight.

Regarding shipping your legal documents, I would first search for a specific shipping service that ships legal documents, rather than a just a normal shipping method. This means the shipping service is already tailored towards the shipment of documents, so will be recognised as a document shipping.

When you select the shipment of a document, and you need to fill in a weight, I would also highly recommend weighing your document (including the packaging you will ship it in) and fill in that amount. Even though this weight will be very low, you need to fill in the lowest weight that is accepted by the form that is closest to the weight of the package.

As long as you completed the customs forms by detailing the contents as legal documents and that this postage was not in fact a commercial import, then customs officials should recognise that there is no need to apply any VAT or duties. However, if you have any doubts, you should be able to contact DHL and have them look into the shipment. You might be able to alter the customs information on your shipment, even if it is still in transit.

Hi Stephanie,

Thank you so much for your helpful reply. I did email DHL but received no reply. I am going to try again because from my understanding a customer should not have to complete the CN22/23 customs form when sending documents, but their online booking system obliges customers to do so even when selecting ‘documents’ from their dropdown menu.

I did weight the package and inserted the replacement value of the documents and clearly stated this. It did not occur to me that there are courier services specialising in delivering legal documents only.

Thanks again for your helpful response.

William

If given items some years ago as gifts then move to an EU country and want to post these items bit by bit from UK to myself in the EU what should you put on the CN22 form as values as never paid for them in first place? Basically personal collectible items so not for sale, not purchased and going from a private UK address to a drop off shop (PO box) in EU. Would appreciate your advice.

Hi Andy,

We specialise in e-commerce and mostly help online retailers ship their products, so this isn’t our area of expertise generally. I can try to help with the knowledge that I have, but please consider getting a second opinion.

From as much as I know, if you’re shipping something for personal use, then this shipment is not a commercial sale and therefore the items should not have a commercial value. Therefore, you should not have to disclose any monetary value on the CN22 form. Just make sure to complete the form stating that it’s a personal shipment, detailing the contents.

It’s a good idea to talk to the customer service of the Post Office or whichever carrier you decide to ship with directly. They will probably have more advice on shipping personal items and making sure customs forms are completed. Something else you could consider is searching for a courier or moving delivery service that specialises in moving personal assets from one country to another. They will probably have better advise on what’s required for the delivery of these products.

Wishing you the best of luck with this!

Thanks for a great article. I’m still not clear on the value we should be using in the CN22 for items send as replacements for faulty or exchanged. And should we be including something like ‘Replacement/exchanged items’ in the description? My accountants tell me that no VAT is due on replacements, which makes sense as the customer has all ready paid VAT on the initial item. But anything sent with zero value on the CN22 is returned by customs. Should we use a nominal value or retail value or even the cost value? And how will this value be excluded from any IOSS reconciliation?

Hi Jane,

Thanks for reaching out – this is a very valid question. I will try my best to provide the correct information, but it might be wise to try talking directly with a customs agent or government official to get more advice on this particular issue.

As I understand, there is a way to reclaim the duties or VAT paid on re-imported goods that were exported from the UK but are being returned unaltered (so in this case, your return products). This means you will complete the CN22 on the returned goods with the correct information, and then you can claim the costs back.

The process is called the Returned Goods Relief. Avalara gives a short introduction to it here: https://www.avalara.com/vatlive/en/vat-news/brexit-vat—import-duties-refunds-on-returns-or-own-goods.html To find out more information and how to make a claim, Gov.uk has a complete breakdown here: https://www.gov.uk/guidance/pay-less-import-duty-and-vat-when-re-importing-goods-to-the-uk-and-eu

I hope this helps!

This I the worse explanation.Like for do t even who?Why UK makes it so complicated?I understand UK ppl are low minded but that is horrendous :-/

Hi Paul,

We understand the frustration caused with shipping to and from the UK, and I’m sorry our explanation isn’t clear for you to follow. Is there a specific instruction that doesn’t make sense, or a step you are stuck with?

Hello, thank you for this and other articles, they’re very helpful.

As you seem highly knowledgeable, I’m hoping you can help me with a question I have.

I ordered some handmade watercolours from Italy, coming to less than £70, including shipping. The seller is new to shipping to the UK and has asked for my NIN for the customs form.

Do I really have to provide this? Wouldn’t having a person’s name, address, phone number AND Ni Number on the outside of a parcel be a dream for ID thieves?

I know this is about Italy but I’m hoping you can advise.

Thank you

Hi Naz,

Thanks for your kind words, and I hope to help you with this. To me, this does sound a bit strange that they are requesting your National Insurance Number. I would be very wary of giving this information out to them. You can see our complete guide here for shipping from the EU to a UK country. This article includes visual examples of the customs forms needed for the delivery of goods to a consumer (so the information you would need to provide as the customer). We also have the guide available in Italian, you can pass this to the retailer you’ve purchased from so they have the correct information they need to ship to you in the UK if they just have the wrong information.

I hope this helps!

Kind Regards,

Steph